拥有Costco Executive会员,每周都会去购物、加油,每次都得花一百多,多得时候有两三百。但是一直不知道一年在Costco花多少钱。

这两天学习了GnuCash的搜索功能(菜单Edit -> Find),发现搜索结果相当于一个虚拟账户,通过给这个账户生成报表,可以得到数据汇总。

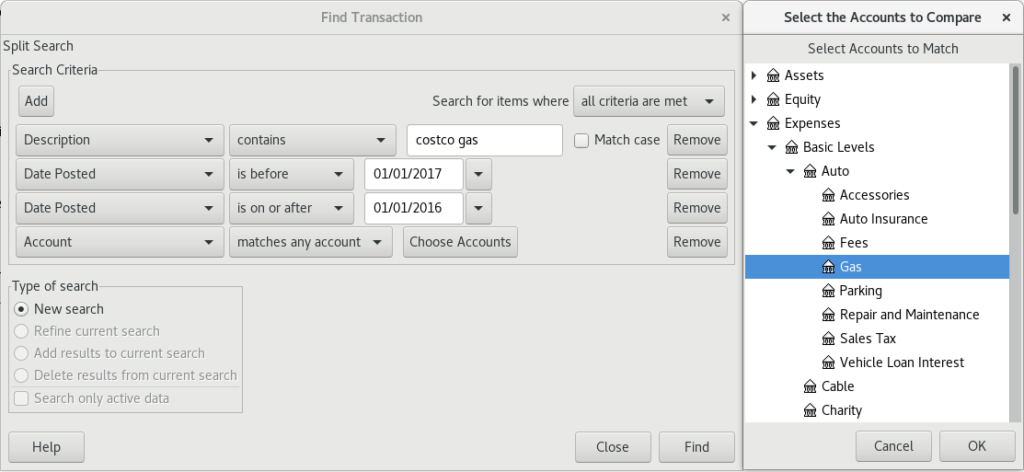

首先尝试一个简单的例子,得出去年在Costco加油的费用,下图是搜索条件,

搜索结果显示在一个虚拟账户标签页,然后通过菜单Reports -> Account Report生产报表,报表最后的Net Change显示去年大概花了一千七百多。

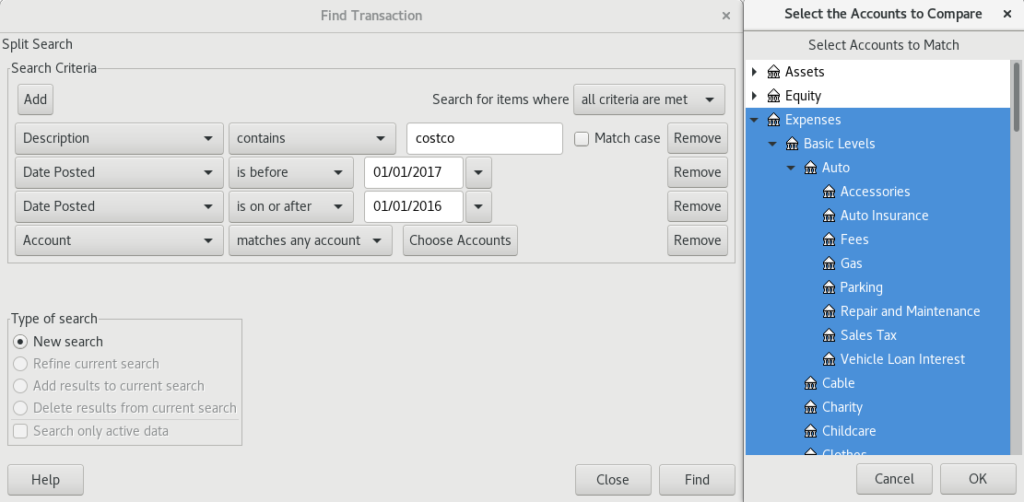

计算在Costco所有消费费用只稍微复杂一点,选中所有费用账户即可,

用同样方法生产报表,Net Change显示费用超过一万!

这个方法有个局限,每条帐目的描述必须包含costco(或costco gas)字样,记录的时候需要留意。